Accessing tax statements

You can now access your 2022 tax statements in UCPath. Here’s what you need to know.

How to Download W-2 in UCPath

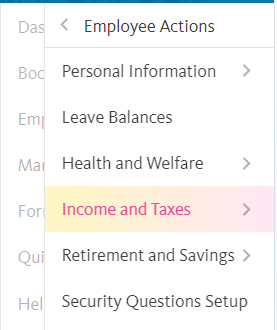

To access the W-2 on UCPath, click on Employee Actions > Income and Taxes > View Online W-2/W-2C

Information for current employees

Starting on January 27, 2023, all employees can access their 2022 W-2 on UCPath online:

- Employees who requested an electronic version of their W-2 received an email on January 27 notifying them of the online availability

- Employees who did not select an electronic version may still access their W-2 on UCPath and will also be mailed a printed W-2 no later than Jan. 31, 2023

Information for former employees

Former employees have access to view or download their W-2 statements (up to three years after their separation date). To access their UCPath W-2, they can visit UCPath and click on Former Employee. Once logged in, click on Employee Actions > Income and Taxes > View Online W-2.

To access historical tax and earnings statements from before your location transitioned to UCPath, go to At Your Service Online (AYSO).

Information for retirees

Your 1099-R statements are available for viewing and downloading from your UC Retirement At Your Service (UCRAYS) account. Go to “Benefit Payments & Taxes” and click “Tax Statements.”

Printed 1099-R forms will be mailed by Jan. 31, 2023, to the address you have on file. UC sends you a printed form unless you request an electronic version.

- Learn more about getting help with UCRAYS.

Have questions or need help?

Please visit UCPath and click on “Ask UCPath Center” to submit an inquiry. You may also call the UCPath Center at (855) 982‐7284 from 8 a.m. to 5 p.m. (PT), Monday through Friday to speak with an associate.